Improving your e-invoicing process is crucial for businesses. This guide explores ways to enhance efficiency and speed up the invoicing system. These tips aim to assist your company in saving time, preventing errors, and maintaining financial accuracy. Let’s delve into the uncomplicated steps to ensure that your billing and invoicing process operates seamlessly.

What is E-Invoicing?

E-invoicing is the electronic way of sending and receiving bills, like using email instead of regular mail. It makes billing faster and more efficient because it’s done on computers. Businesses save time and resources by not dealing with physical paper invoices. E-invoicing also reduces errors from manual data entry. In this system, invoices are sent and received through computers, making it faster and more accurate.

Invoice Definition:

An invoice is like a grown-up receipt that sellers give to buyers. It’s a formal paper showing what stuff or services were bought and how much they cost. The invoice lists everything clearly, including the number of items, individual prices, any taxes, and the total bill. It’s an important paper for businesses to keep track of what they sell, manage their stuff, and make sure they get paid on time.

When a business sells things, they create an invoice to show exactly what was bought and how much it costs. This document helps both the seller and the buyer keep things organized. The invoice includes details like the quantity of items, the price for each item, any extra costs like taxes, and the overall amount the buyer needs to pay. It’s like a grown-up’s way of making sure everyone knows what they’re paying for, so there are no misunderstandings. Businesses use invoices to stay on top of their sales, keep their inventory in check, and make sure they get the money they’re owed.

E-Invoicing and GST:

E-invoicing means using computers to create and exchange bills between businesses instead of using paper. When we connect this with GST, it helps in managing taxes better. Picture it like this: businesses now use electronic invoices that follow a specific format. This makes it easier for them to report their transactions for GST. It’s like having a common language for invoices.

By doing this, we’re making sure that the tax process is clear, and mistakes are less likely to happen. E-invoicing also creates a digital record of transactions, making it harder for people to cheat on taxes. So, when we talk about E-invoicing and GST, we’re essentially talking about using computers to make invoicing smoother and ensure everyone follows the rules for taxes.

Also read – Exploring Basics of Accounting Terminology

Online Invoice Software:

Online Invoice Software acts as a digital helper for businesses, making invoicing tasks easy through the internet. It helps create, send, and track invoices efficiently. This tool speeds up the invoicing process by automatically calculating amounts and storing all invoice details in one place. Think of it as a smart assistant for handling business finances online.

Moreover, an online invoice generator allows businesses to customize their invoices for a professional look. It saves time and reduces errors by automating calculations. With this tool, you can send invoices electronically and easily keep track of payment status. It’s a useful digital tool that simplifies the entire invoicing process, making it more efficient and accurate for businesses.

How to Generate E-Invoice:

Making an electronic invoice is straightforward:

- Open Your Invoicing Tool: Begin by launching the software you use for creating invoices, like MargBooks, Xero, or a similar tool.

- Locate the Invoice Section: Look for the section that says “Create Invoice” or something similar within the tool.

- Enter Customer Details: Input your customer’s information, such as their name, address, and contact details.

- Add Your Business Info: Include your business details, like your company name and contact information, to show who is sending the invoice.

- Fill in Invoice Info: Enter the invoice number, the date of sending, and the expected payment date.

- List Your Items: Specify the products or services being charged, along with quantities and costs.

- Calculate the Total: Let the tool handle the calculations, including costs and any applicable taxes.

- Attach Any Documents: If necessary, attach supporting documents like receipts.

- Check for Mistakes: Take a quick look to ensure there are no errors in the details.

- Create and Send: Click the button to generate your e-invoice. You can usually send it via email or download it for later sending.

- Keep an Eye on Payments: Use the tool to monitor if your customer has made the payment. This helps you manage your finances effectively.

By following these steps, you can easily create and send an e-invoice without any complications.

What is a proforma invoice?

A proforma invoice is like a sneak peek or an early estimate of the bill you’ll receive when purchasing something. It’s provided by the seller before you actually receive the items you bought. This document shows the expected costs, such as prices and quantities, so you know what you’re going to pay. It’s not a final bill, just a heads-up. People often use it in international trade to make things smoother when goods cross borders. It’s like a roadmap for both the buyer and the seller, helping them agree on what’s what before the real payment details come into play.

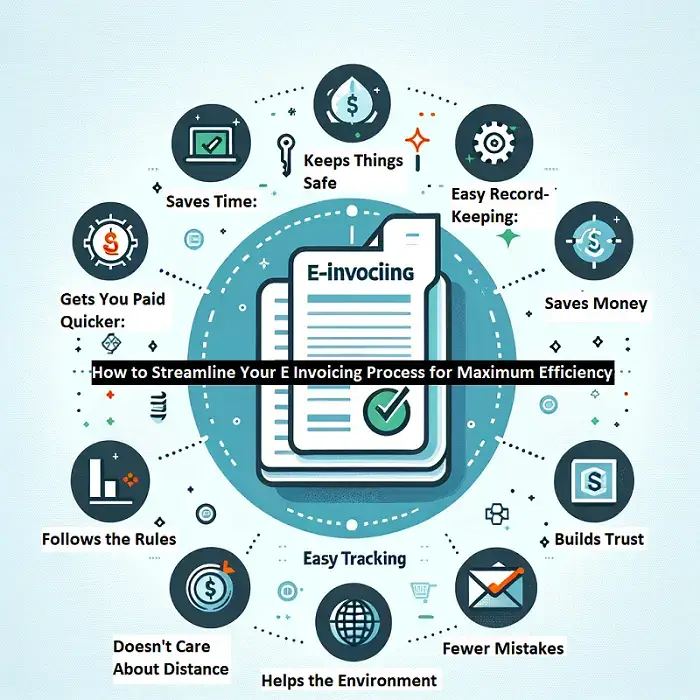

Benefits of E-Invoicing:

Now, let’s talk about the good stuff—why bother with e-invoicing? Well, here are some awesome benefits:

- Saves Time: E-invoicing speeds up billing by doing things automatically. This means less waiting for money.

- Saves Money: No need for paper, stamps, or manual work. E-invoicing cuts costs, making business operations more affordable.

- Gets You Paid Quicker: E-invoicing brings in payments faster, keeping cash flowing for smooth business operations.

- Fewer Mistakes: E-invoicing reduces errors. No more getting numbers wrong or missing details, ensuring accuracy and reliability.

- Easy Record-Keeping: Digital invoices are like organized folders on a computer, making it simple to track money coming in and going out.

- Helps the Environment: Using less paper is good for the planet. E-invoicing is eco-friendly and reduces the need for cutting down trees.

- Follows the Rules: E-invoicing systems ensure businesses follow rules and regulations, keeping everything legal and avoiding problems.

- Keeps Things Safe: Digital invoices can be locked up tight, keeping your financial information safe and secure from unauthorized access.

- Doesn’t Care About Distance: E-invoicing lets businesses send and receive bills from anywhere in the world, breaking down barriers and making global transactions easier.

- Builds Trust: Sending accurate and timely invoices builds trust with partners. E-invoicing helps maintain good relationships with other businesses.

E-invoicing is like a helpful assistant that saves time, money, and the environment while ensuring that everything is correct, secure, and follows the rules.

Invoice Processing:

Invoice processing involves keeping track of the money your business owes to others. When you receive a bill from a supplier, you need to check if everything is correct, like the prices and the items you purchased. If there’s an issue, you communicate with the supplier to resolve it.

Once you’re confident that everything is accurate, you input the billing information into your financial records to stay organized. The bill might then require approval from specific people in your company before you can make the payment.

After receiving approval, it’s time to pay. Timely payments are crucial for maintaining good relationships with your suppliers and may even save you money if there’s an early payment discount.

Throughout this process, it’s essential to follow the rules and laws related to money and taxes. Adhering to these guidelines ensures that your business operates smoothly. In simple terms, managing invoices is about making sure you pay the correct amount at the right time and abide by the rules.

Tips for a Smooth E-Invoicing Journey:

Now that you know the basics, let’s talk about some simple tips to make your e-invoicing journey smoother:

- Use Digital: Save your invoices on the computer to find them easily.

- Choose Good Software: Find a good online tool for making invoices. Ask for advice or check reviews.

- Stay Organized: Make a system to organize invoices by date, client, or project for quick access.

- Teach Your Team: If you have a team, train them to use e-invoicing easily.

- Check Everything: Before sending invoices, double-check details to avoid mistakes and delays.

- Keep Up with Changes: Stay updated on e-invoicing rules and tools changes.

- Get Paid Quickly: E-invoicing helps you get paid faster. Encourage clients to pay on time for smooth business.

Remember, e-invoicing is meant to make your life easier, so explore and find what works best for you.

Conclusion:

Switching to e-invoicing may seem like a big change, but it’s all about making your life easier. It saves you time and money, ensures everything is accurate, and helps you get paid faster. So, give it a shot, explore e-invoicing, and watch your business thrive with less hassle! If you have any more questions, feel free to ask. Happy invoicing!

Frequently Asked Questions about E-Invoicing:

What is e-invoicing?

E-invoicing is the electronic exchange of invoices between businesses and their clients or suppliers, replacing traditional paper-based methods with digital processes for billing and payment.

Why should I use e-invoicing?

E-invoicing offers numerous benefits, including faster invoice processing, reduced errors, lower costs associated with printing and postage, improved cash flow management, and enhanced security of financial transactions.

How does e-invoicing work?

E-invoicing involves generating invoices electronically using specialized software or platforms, then transmitting them directly to the recipient’s system through secure channels such as email, EDI (Electronic Data Interchange), or API (Application Programming Interface) integration.

Is e-invoicing secure?

Yes, e-invoicing utilizes encryption and secure transmission protocols to safeguard sensitive financial data, reducing the risks of fraud, unauthorized access, and data breaches compared to paper-based invoicing methods.

What are the compliance requirements for e-invoicing?

Compliance with e-invoicing regulations varies by country and industry. It typically involves adherence to specific technical standards, legal frameworks, and tax regulations governing electronic invoicing to ensure validity, authenticity, and legal acceptance of digital invoices.

How can e-invoicing improve efficiency?

E-invoicing streamlines the entire invoicing process, from creation and delivery to payment reconciliation, by automating repetitive tasks, reducing manual errors, enabling faster approval cycles, and providing real-time visibility into invoice status and payment processing.

Is e-invoicing suitable for small businesses?

Yes, e-invoicing is beneficial for businesses of all sizes, including small and medium enterprises (SMEs). It helps SMBs save time and resources by simplifying invoicing workflows, accelerating payment cycles, and enhancing financial management practices.

What are the cost implications of adopting e-invoicing?

While initial setup costs and subscription fees for e-invoicing solutions may vary, businesses can achieve significant cost savings in the long run through reduced paper, printing, and postage expenses, as well as lower processing and administrative overhead associated with manual invoicing.

How can I integrate e-invoicing into my existing systems?

E-invoicing solutions often offer seamless integration with accounting software, ERP (Enterprise Resource Planning) systems, and other financial management tools through APIs or standard file formats, enabling businesses to automate invoicing processes without disrupting existing workflows.

What are the key considerations when choosing an e-invoicing solution?

When selecting an e-invoicing solution, businesses should evaluate factors such as ease of use, scalability, compliance with regulatory requirements, integration capabilities, security features, customer support, and overall cost-effectiveness to ensure optimal efficiency and ROI.